Grain Spreads: Corn Firms into WASDE

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather and the charts. Sign Up Now

Commentary

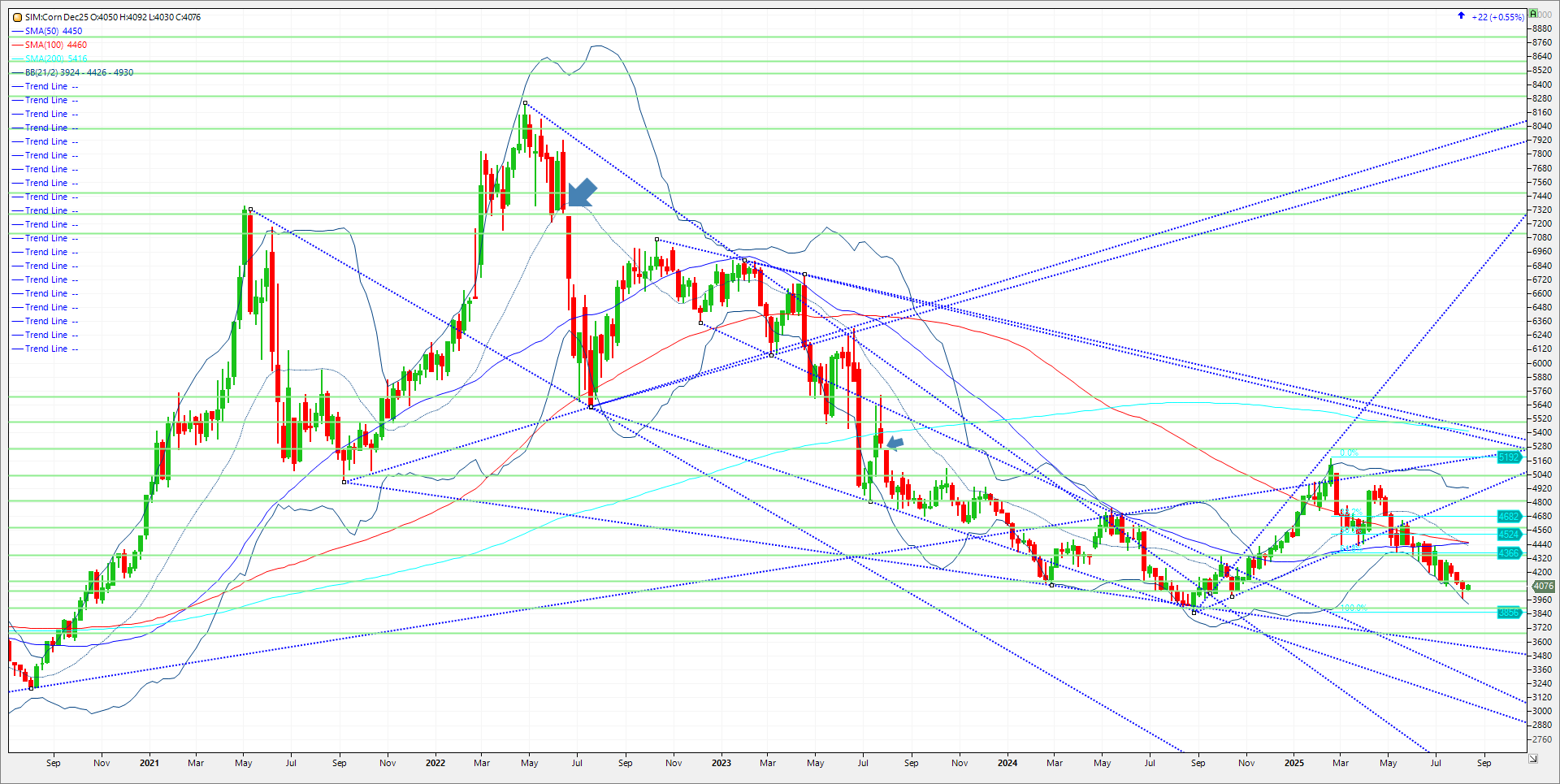

Corn closed with minor gains supported by strength in beans and short covering. Weekly export inspections once again came in above the highest guess. US export inspections for the prior report turned out 1.5 million metric tons versus 990K a year ago. This brings the US marketing year’s inspections to 63.1 million metric tons vs 49 million for the same period a year ago. US prices are still the cheapest in the world. Today's high temperatures are forecasted to be very mild in the western belt with heat lingering in the east, but temperatures will be on the rise next week across the most of the Midwest. Precipitation is expected to be the greatest this week in the north-central Midwest. Some field and grain storage damage from severe storms in Nebraska was reported over the weekend. The corn market, not being the target of trade with China, has the prospects of a record yield revealed in the Crop Production report tomorrow cap the gains. The average trade guess heading into the report is around 184 bushels per acre, and accompanying production is near 16 billion bushels. The big number for me is ending stocks and how the surge in demand could potentially offset the increase in production year on year. Keep in mind last year, yield was projected near 183, but was revised lower by November down to 179. Hot and dry late can take the top off the crop in beans and corn. Will we see that type of weather event emerge again? Technical levels to watch in December corn show support at 4.03 to 397. A close under and its 3.90 to 3.85. Resistance is 4.12 and then 4.16. Consecutive closes above these areas could prod fund shorts to push the market to 4.30 to 4.35.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.