Meta Stock Could Soar Past $1,000 Thanks to AI – Time to Buy?

/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

Meta Platforms (META) is aggressively investing in artificial intelligence (AI). The company’s management recently said that 2025 capital expenditures could range between $66 and $72 billion. That’s roughly $30 billion more than last year, and a large chunk of this capital would go towards rapidly scaling its AI infrastructure.

Naturally, these significant investments raise concerns. Can Meta maintain healthy profit margins in the short term? And will these hefty investments translate into long-term gains?

Despite those concerns, early signs suggest that Meta's AI strategy is already beginning to pay off. Improvements in user engagement and stronger monetization, both fueled in part by AI innovations, are helping to drive optimism about the company's long-term outlook.

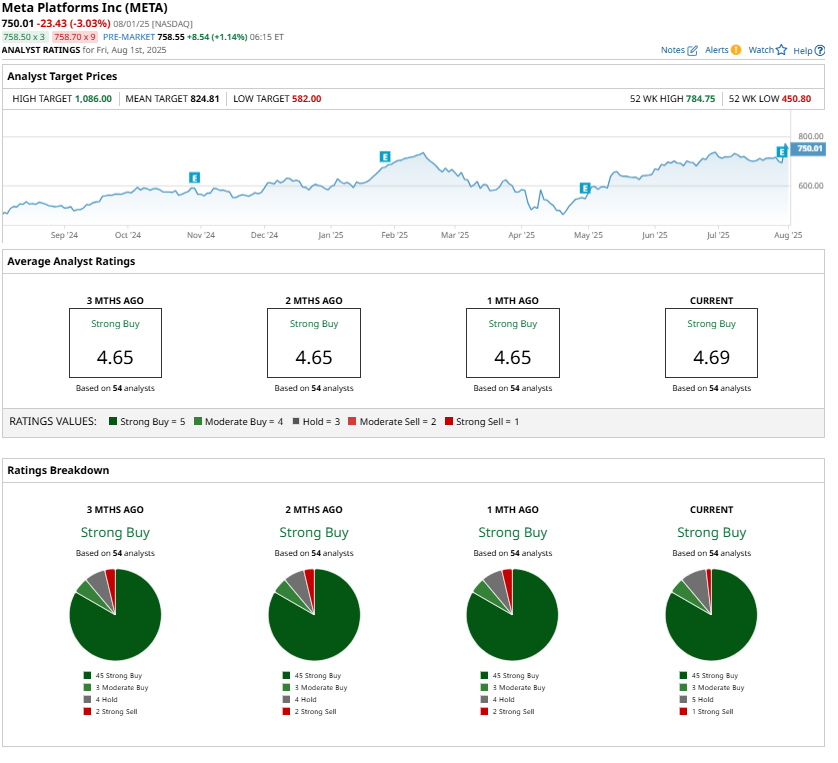

Notably, at least one Wall Street analyst expects Meta stock to top $1,000 over the next 12 months. To be precise, the Street-high price target for Meta stock is now $1,086, representing a potential upside of around 41.5% from current levels.

AI is Meta’s Rocket Fuel

AI is emerging as the catalyst that's helping Meta to enhance its user engagement, improve content discovery, boost ad performance, and drive overall revenue growth. Notably, the number of daily active users (DAUs) continues to rise across its platforms, including Facebook, Instagram, and WhatsApp. In fact, in June, over 3.4 billion people used at least one of Meta’s apps every day.

Across Facebook, Instagram, and WhatsApp, AI is increasingly fine-tuned to deliver content that users find both relevant and compelling. These improvements are translating into more time spent on the platforms. In the second quarter, time spent watching videos on Instagram surged over 20% year-over-year globally. Facebook saw similarly strong growth, especially in the U.S., where video engagement also climbed by more than 20%. These gains reflect Meta’s ongoing improvements in its recommendation algorithms, which continue to evolve and become more responsive to users’ real-time interests.

Thanks to these initiatives, Meta saw a 5% jump in average time spent on Facebook and a 6% increase on Instagram in just one quarter. Further, Meta AI is already reaching over a billion monthly users, and the focus is shifting toward creating deeper, more personalized experiences, which are expected to drive engagement levels higher.

AI is also supercharging Meta’s advertising business. In Q2, the company’s total Family of Apps revenue hit $47.1 billion, up 22% year-over-year. Advertising revenue specifically came in at $46.6 billion, up 21%. Growth was strongest in Europe and the rest of the world region, where ad revenue climbed 24% and 23% respectively, with North America and Asia-Pacific also posting solid gains.

Meta’s upgraded recommendation models are now live on more ad surfaces, driving around 5% more ad conversions on Instagram and 3% on Facebook. More advertisers are also tapping into Meta’s generative AI tools for ad creative, with a significant portion of ad revenue now coming from campaigns that utilize its Gen AI features.

Meta is gaining strong traction with its Advantage+ suite of AI-powered tools. Its Advantage+ Creative suite is seeing growing adoption of generative AI features. Nearly 2 million advertisers are now using its video generation tools—Image Animation and Video Expansion. Meta is also seeing promising results from its AI-driven text generation tools, which continue to improve as new features are added.

Overall, by enhancing user engagement, improving content discovery, and boosting ad performance, AI is driving significant gains across Meta’s platforms. With billions of users and strong momentum in both user activity and advertising revenue, Meta’s strategic focus on AI is paying off and will drive its long-term growth.

Is Meta Stock a Buy Now?

Meta stock has gained over 56% in the past year. Despite the significant appreciation in its price, Meta’s aggressive investment in AI is becoming the engine behind its next phase of growth. From higher user engagement and improved ad performance to the rapid adoption of its AI-powered tools, the early results are promising. While the scale of spending raises short-term concerns, the long-term upside could be substantial if current trends continue.

Wall Street is optimistic and maintains a “Strong Buy” consensus rating on Meta stock, reflecting confidence in the social media giant’s growth story, particularly as it integrates AI into its products.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.