Meta Platforms Just Hired One of ChatGPT’s Co-Creators. Is META Stock a Buy Here as Zuckerberg Doubles Down on AI?

Mark Zuckerberg-led Meta Platforms (META) has appointed former OpenAI researcher Shengjia Zhao as the chief scientist of its Meta Superintelligence Labs, a new division within Meta, led by Zuckerberg’s vision to create artificial general intelligence (AGI) that surpasses human capabilities. Touted for his significant contributions in building ChatGPT, GPT-4 and the company’s first AI reasoning model, o1, Zhao joins a super team at Meta, where Zuckerberg has assembled some of the best minds in AI globally.

Commenting about Zhao’s addition to the team, Zuckerberg said, “I’m excited to share that Shengjia Zhao will be the Chief Scientist of Meta Superintelligence Labs. Shengjia co-founded the new lab and has been our lead scientist from day one. Now that our recruiting is going well and our team is coming together, we have decided to formalize his leadership role.” Zhao will lead the research initiatives at the unit headed by Alexandr Wang, the founder of Scale, in which Zuckerberg invested an eye-watering $14 billion to acquire a 49% stake.

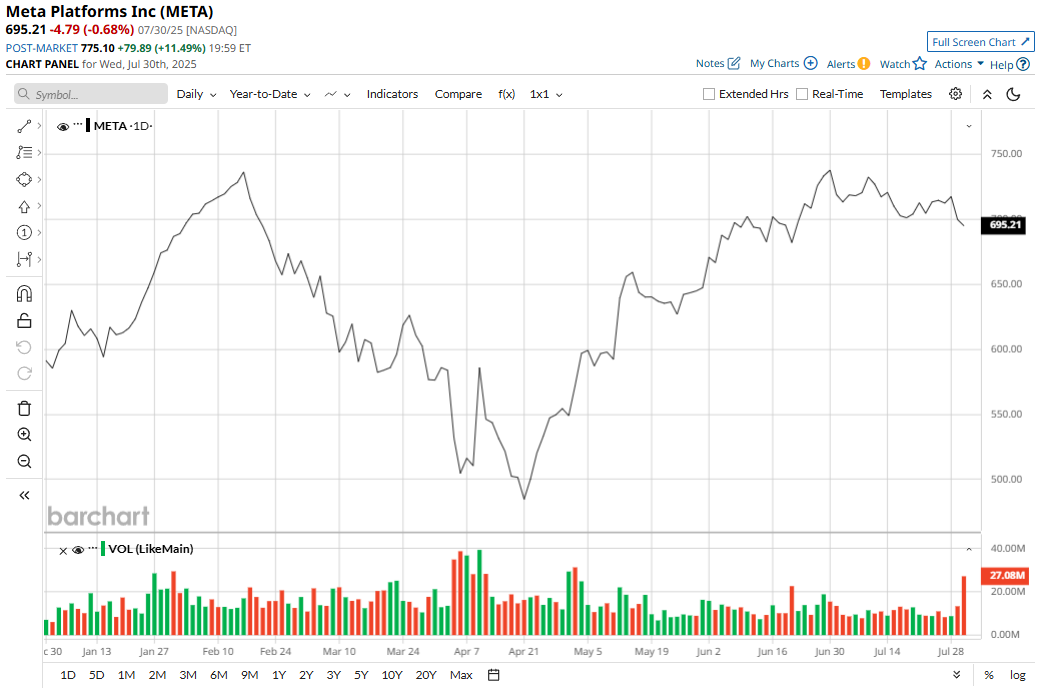

Shares of Meta are up 32% on a YTD basis, and it boasts a market cap of about $1.8 trillion.

Meta Posts a Blowout Q2

Meta’s spending spree on high-profile hires and capex rollout to build its AI capabilities would make one think that it is coming at the expense of the company’s financials. The reality is far from that.

In the past 10 years, Meta’s revenue and earnings have compounded at annual growth rates of 28.85% and 37.25%, respectively. Moreover, it has reported an earnings beat in each of the past nine quarters, including the latest Q2.

In Q2 2025, Meta reported revenues of $47.5 billion, up 22% from the previous year. Core advertising revenues continued to drive overall topline growth, coming in at $46.6 billion, which marked a yearly rise of 21.5%. Earnings witnessed an even sharper yearly growth of 38% to $7.14 per share, well ahead of the consensus estimate of $5.92 per share. Encouragingly, operating margins improved as well to 43% from 38% in the year-ago period.

Daily active people (DAP) and average price per ad rose by 6% to 3.48 billion and 9%, respectively.

Net cash from operating activities increased by 32% from the previous year to $25.6 billion. However, free cash flow dropped to $8.55 billion from $10.9 billion in the prior year. The decline in cash flows should not be seen as a negative, instead it is transient and is a sign of the company’s huge spending on data center infrastructure and hiring, which will ultimately drive growth in the future.

For Q3, the management projects revenue to be in the range of $47.5 billion to $50.5 billion, the midpoint of which would denote yearly growth of 20.7%. Further, analysts are forecasting the company to report earnings of $6.49 per share compared to $6.03 per share in the year-ago period.

Poised to Dominate the Consumer AI Space

Meta’s most compelling asset is its deeply ingrained presence globally, primarily via its flagship platforms WhatsApp, Instagram, and Facebook. This characteristic starkly differentiates the company from other hyperscalers such as Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL), all of whom, despite their commitments to AI, remain primarily focused on enterprise solutions.

Notably, Meta maintains a completely integrated, proprietary ecosystem, serving a staggering 3.5 billion active users, and concurrently operates what stands as the world's most extensive end-to-end AI-focused advertising platform. Equipped with these formidable resources, Meta’s vision for personal superintelligence, its ambition to construct AI agents tailored for individuals, gives it a distinct competitive edge and unlocks an addressable market of truly gargantuan proportions.

Furthermore, Meta finds itself in a unique position to monetize artificial intelligence without necessitating significant additional expenditure. In fact, the company is already leveraging AI to generate revenue within its foundational business activities, including the precision of its advertising, the efficacy of its user targeting, and the insightful analysis of consumer behavior. This ongoing monetization is occurring simultaneously with the development of its underlying AI infrastructure, largely obviating the need to re-engineer existing systems, a direct benefit derived from its Llama3 large language model.

Analysts are unsurprisingly projecting industry-beating growth rates for Meta with forward revenue and earnings growth rates pegged at 16.82% and 24.60% compared to the sector medians of 3.47% and 12.73%, respectively.

Analyst Opinions on META Stock

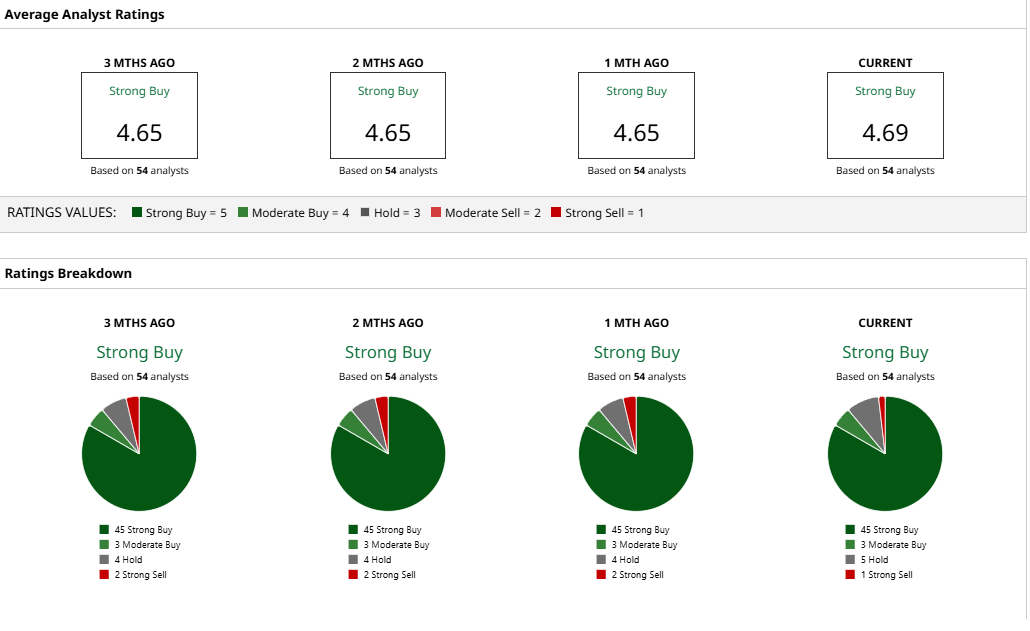

Overall, analysts have given a consensus rating of “Strong Buy” for META stock, with a mean target price of $757.98. This is slightly below its current trading price.

Out of 54 analysts covering the stock, 45 have a “Strong Buy” rating, three have a “Moderate Buy” rating, five have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.