Mark Zuckerberg Is Wooing Wall Street With AI Again. Is It Too Late to Buy META Stock?

%20the%20world's%20rendezvous%20for%20startup%20and%20leaders%20by%20Frederic%20Legrand.jpg)

Meta Platforms (META) released its Q2 2025 earnings yesterday, July 30, and the stock is trading sharply higher today, as the company not only reported better-than-expected numbers for the June quarter, but also provided an upbeat outlook for the current quarter. In this article, we’ll discuss whether Meta stock remains a buy despite today’s rise, as CEO Mark Zuckerberg once again showed off the company’s artificial intelligence (AI) strategy to the markets.

Meta Beats Q2 Earnings

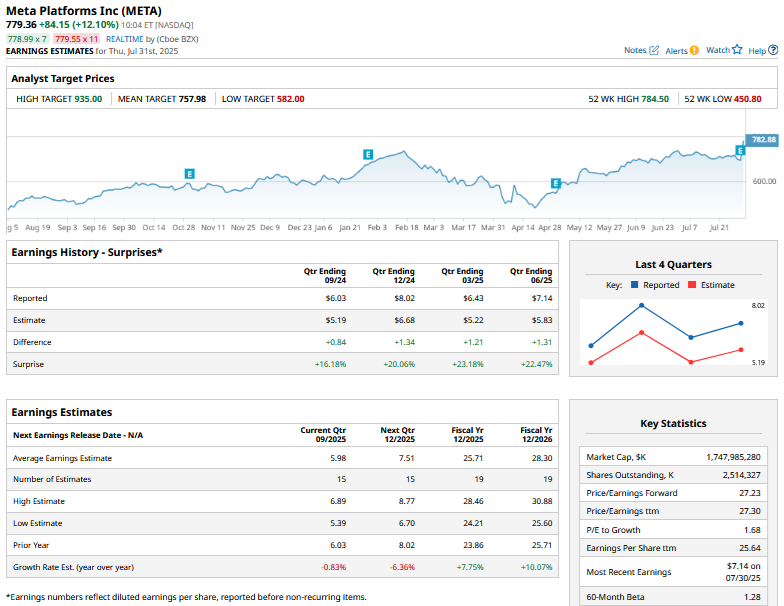

Meta reported revenues of $47.52 billion in Q2, up 22% year-over-year and well ahead of the Street estimate of $44.8 billion, as well as the $42.5 billion to $45.5 billion that the company guided for. The beat on the bottom line was even more spectacular. Meta’s Q2 earnings per share of $7.14, up 38% year over year, dwarfed the $5.92 that analysts were modeling.

Meta guided for Q3 sales between $47.5 billion and $50.5 billion, ahead of the consensus estimate of $46.14 billion. Here are some of the other key takeaways from the report.

- Hiring Activity Will Lead to Higher Expenses: Meta expects headcount growth in 2025 and 2026 as it continues to add employees in its “highest priority areas.” The company expects total expenses to grow by between 20% and 24% this year and expects “meaningful upwards pressure” on 2026 expenses. Meta expects higher depreciation expense on growing capex to be the biggest driver of expense growth, followed by employee compensation.

- Capex Spending to Increase in 2026: During the Q2 earnings call, Meta CFO Susan Li talked about ramping up AI investments in 2026. “We continue to see very compelling returns from our AI capacity investments in our core ads and organic engagement initiatives, and expect to continue investing significantly there in 2026.”

- Metaverse Losses Balloon While Sales Stay Tepid: Meta’s Reality Labs segment, which is building the metaverse, reported revenues of only $370 million in Q2, which trailed Street estimates. While that segment’s operating loss rose slightly compared to the corresponding period last year to $4.53 billion, it was narrower than expected. Its quarterly operating losses have been in the ballpark of $4 billion for the last three years, and the collective losses since late 2020 have accumulated to a whopping $70 billion. While the company’s Quest headsets failed to take off, Meta said that sales of Ray-Ban Meta smart glasses more than tripled in the first half of this year. Zuckerberg, meanwhile, remains optimistic on that segment and said that AI will only accelerate things.

- WhatsApp Monetization: Meta is rolling out ads in Status and Channels. The company expects the ads in WhatsApp status to have a lower average selling price than Facebook and Instagram, but monetizing the WhatsApp user base is one of the major opportunities for Meta in the medium to long term.

Zuckerberg Woos Markets with AI Strategy

During Meta’s Q1 earnings call, Zuckerberg shattered the perception that AI is a bubble. The Q2 call was a step forward in that direction as the Meta CEO talked at length about how the company is taking its AI strategy forward, and towards the beginning of the call itself claimed that “superintelligence” – or AI surpassing human intelligence – is now in sight.” According to him, AI glasses will help “integrate superintelligence into our day-to-day lives.”

Zuckerberg also put to rest concerns over AI monetization and said that the strong advertising growth in the quarter, which was well ahead of analysts’ estimates, was largely due to “AI unlocking greater efficiency and gains across our ads system.”

Specifically, he said that the AI-powered recommendation model helped drive nearly 5% more ad conversions on Instagram while the corresponding number for Facebook was 3%. Similarly, the model helped drive an increase in time spent on Instagram and Facebook by 6% and 5%, respectively. Zuckerberg reiterated his previous view and said, businesses “will soon have a business AI just like they have an email address, social media account, and website.”

Meta Stock Forecast: Is It Too Late to Buy Now?

Meta has risen to an all-time high today and is on the cusp of becoming a $2 trillion behemoth. Expectedly, sell-side analysts have been raising the stock’s target price following the confessional. D.A. Davidson, for instance, raised Meta’s target price from $650 to $825 while Morgan Stanley raised its from $750 to $850.

I believe it’s still not too late to buy Meta stock, especially for patient investors, and I still see it as among the best AI plays out there. While the stock’s valuations are trending above historical averages, the Facebook parent has earned the right to premium valuations with its aggressive yet successful and efficient AI strategy.

On the date of publication, Mohit Oberoi had a position in: META . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.