BlackSky Rockets 125% in a Month, Is It Too Late to Buy BKSY Stock?

Shares of BlackSky Technology (BKSY) have been on a tear lately, skyrocketing 125% in just one month. The surge comes amid rising optimism around global defense spending, which has put a spotlight on companies like BlackSky that are deeply embedded in national security and intelligence operations. With geopolitical tensions and global surveillance needs escalating, BlackSky’s long-term prospects remain solid.

BlackSky, a space technology company, specializes in real-time satellite imagery, data analytics, and high-frequency monitoring of high-value locations worldwide. Operating a fleet of low Earth orbit (LEO) satellites, BlackSky provides customers with the ability to observe strategic zones and events as they unfold, capabilities that are increasingly critical to defense, intelligence, and disaster response agencies.

The company’s customer base is heavily skewed toward the U.S. and allied defense and intelligence sectors. This positions BlackSky to directly benefit from expanding government budgets for surveillance and other related technologies. As military and security priorities continue to shift toward rapid-response intelligence and global monitoring, BlackSky's offerings seem tailor-made for the new defense landscape.

But with BKSY stock already delivering triple-digit gains in such a short span, is it too late to buy its shares?

Contracts, Satellites, and Strategy: BlackSky’s Next Growth Phase

BlackSky entered 2025 with considerable momentum, continuing to build on the strong performance it demonstrated last year. The company’s focus on space-based intelligence positions it well to benefit from the growing demand for high-resolution satellite imagery, particularly among defense and intelligence agencies.

The first quarter of 2025 saw BlackSky secure more than $130 million in new contracts and renewals, driven by several multi-year agreements. These deals reflect the increasing demand for BlackSky’s imaging services and signal a growing commitment from government agencies to secure long-term access to vital intelligence capabilities. One of the most notable wins includes a groundbreaking deal to support the development of India’s commercial Earth observation sector, reflecting BlackSky’s expansion into emerging international markets.

The robust contract activity drove a 50% year-over-year increase in BlackSky’s backlog, offering enhanced visibility into the company’s revenue outlook. These long-term agreements, primarily related to high-margin imagery and analytics services, indicate a stable and growing foundation for future expansion.

BlackSky’s first Gen-3 satellite has passed extensive testing with performance exceeding expectations. A second Gen-3 satellite was recently launched, marking the start of a series of planned deployments throughout the remainder of the year. These advanced satellites promise higher resolution imagery, faster revisit rates, and increased capacity. These capabilities will boost the demand for its high-margin analytics and imaging services.

This acceleration in satellite deployment is expected to unlock new revenue streams and deepen existing relationships. Many of BlackSky’s current contracts, including its Electro-Optical Commercial Layer (EOCL) agreement with the U.S. government, are structured to grow in tandem with the company’s expanding imaging capabilities. As Gen-3 satellites begin commercial service, anticipated to roll out more broadly in Q4, customers will gain access to even more actionable intelligence, further increasing the value proposition of BlackSky’s platform.

Financially, the company continues to strengthen its position, improving liquidity and ensuring it has the resources to invest in key growth initiatives. Its expanding sales pipeline reflects the growing interest in multi-year subscriptions tied to the Gen-3 rollout, and successful conversions from this pipeline should contribute to further backlog growth and long-term revenue predictability.

Should You Still Chase the Rally in BKSY Stock?

While the recent rally reflects growing confidence in BlackSky’s long-term potential, it also raises questions about short-term valuation. The rapid appreciation in share price indicates that a portion of future growth has already been factored into the price. That said, if the trend of rising defense budgets continues and if BlackSky can secure additional high-value government contracts, there may still be runway ahead.

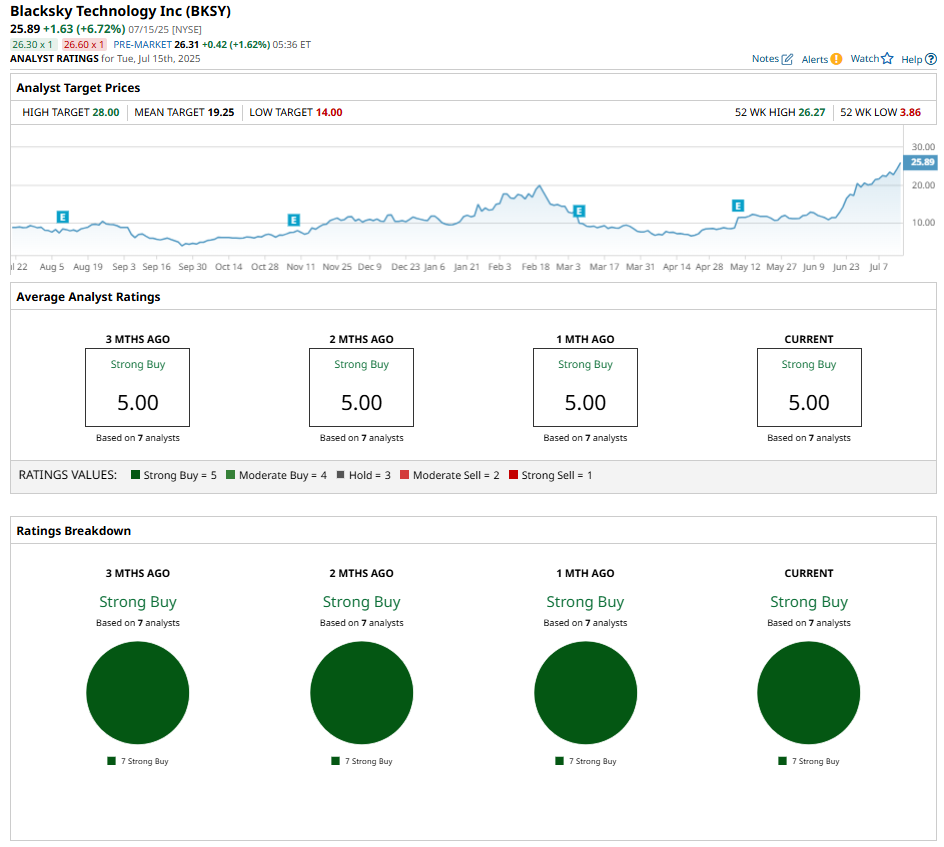

Wall Street analysts are bullish about BKSY’s prospects and have a “Strong Buy” consensus rating.

In essence, BlackSky will benefit from strong tailwinds from a shifting geopolitical climate and increasing demand for real-time satellite intelligence. While its long-term prospects remain solid, a pullback could provide a solid entry point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.