Is it Time for the "Heat Unit" Hens to Start Cackling?

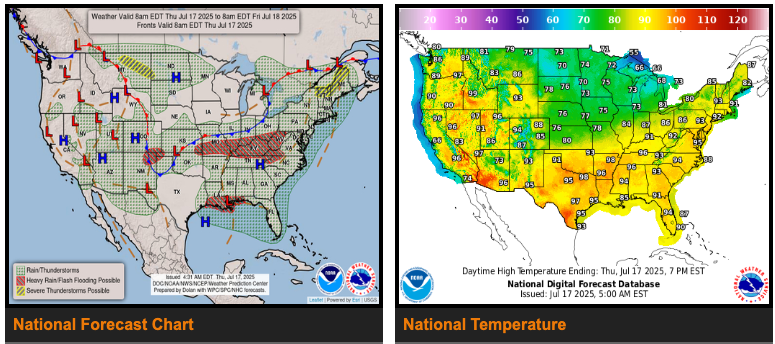

Weather across the US Plains and Midwest has a fall-like feel to it Thursday morning. This will likely set off the seasonal squawking about a lack of “heat units” for the US corn crop.

The corn market has rallied this week, despite reads on real fundamentals remaining neutral-to-bearish.

Thursday morning will see the release of the latest weekly export sales and shipments numbers. Let's see if China is actually “saving the US soybean industry” again.

Morning Summary: As I was making my first round of coffee this morning, a check of the weather told me it was 17°(C)/63°(F) in Omaha with a mild north breeze blowing. On July 17. While it’s true North America has crossed summer’s midpoint (winter for South America), it seems a bit early for an almost fall-like feel. Unfortunately, I know this type of weather inevitably brings with it two things: First, someone somewhere will reference something pumpkin spice flavored. Second, the “Heat Unit” hens will be cackling loudly in the corn market. What do I mean by this? Given everything always has to be bullish, the fact it isn’t triple-digits across the US Plains and Midwest will mean corn production is being reduced dramatically every second of every hour of every day. Or something like that. Of course, if temperatures were in the triple-digits, these same folks would be telling us it is too hot for corn to pollinate. So, there’s that. Speaking of cooling off, US boxed beef markets dropped again Wednesday afternoon with choice falling $4.87 and select reportedly down $4.67 for the day. This again raises the question of if the recent drop is due to changes in supply or US consumers finally saying enough is enough.

Corn: The corn market was quietly lower overnight through early Thursday morning. This isn’t overly surprising given both Thursday’s forecast calling again for rains over the Plains and Midwest and the early morning radar showing a system moving across Kansas and into Missouri and Illinois pre-dawn. There has been a good deal of excitement in the corn market this week with contracts closing higher the past three sessions after hitting new lows overnight through early Monday morning. There are a number of ways to look at what has been going on, including a possible Benjamin Franklin Fish Analogy. This tells us that like guests and fish, markets start to stink after three days of moving against the trend. But does this fit corn’s situation if the long-term trend is still up, the short-term trend has turned up, and the intermediate-term trend could change direction at Friday’s close? We could also talk about a possible Rubber Band Disposition given the recent change in technical indicators while our reads on real market fundamentals remain neutral-to-bearish. Then there is corn’s characteristic Round Number Reliance to think about. As of this writing, September (ZCU25) is holding above $4.00 while December (ZCZ25) is sitting north of $4.20[i]. We’ll see how Thursday plays out.

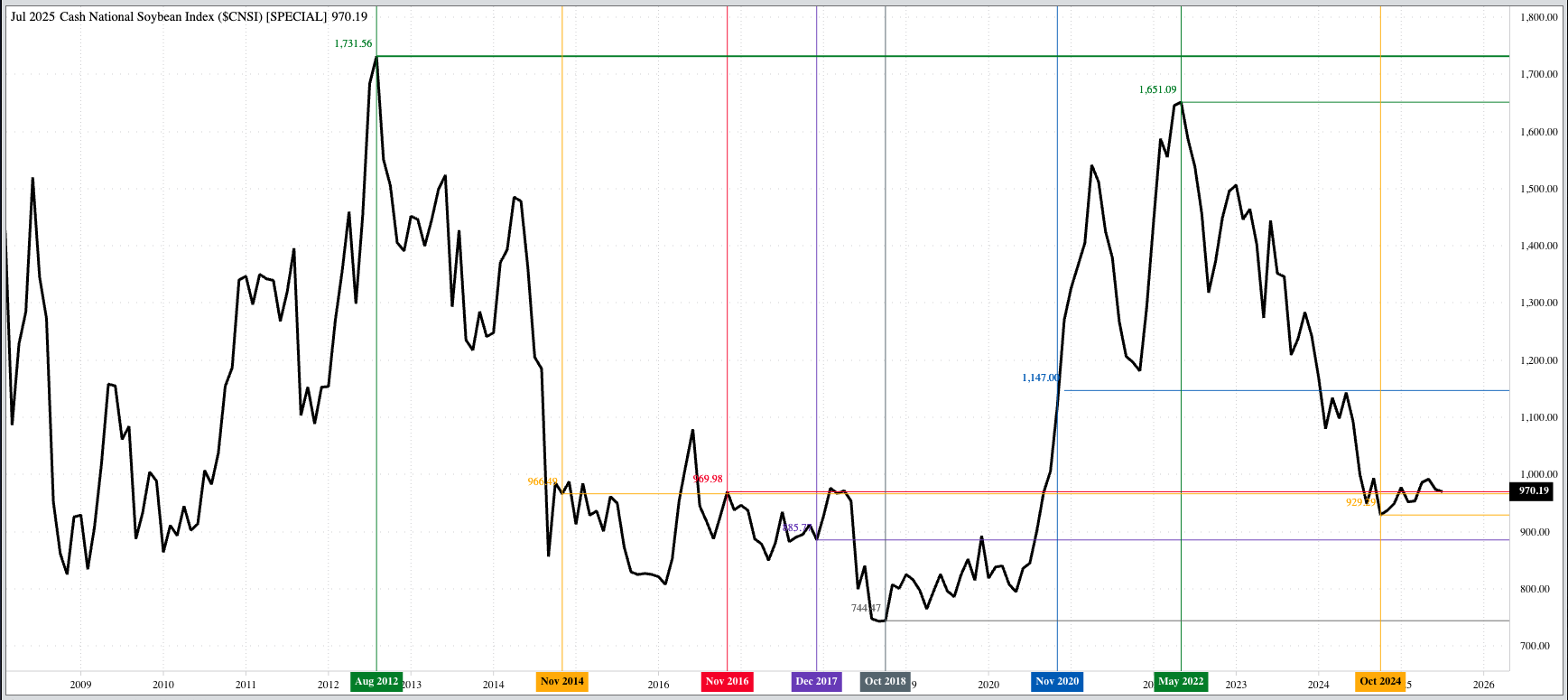

Soybeans: The soybean market was also quietly lower to start the day. Here we see the November issue (ZSX25) 1.25 cents in the red after slipping as much as 4.5 cents overnight on trade volume of 20,000 contracts. Again, I don’t see anything to get excited about pre-dawn. Given this, let’s turn our attention to the soon to be released weekly export sales and shipments update, this one for the week ending Thursday, July 10. As I talked about in Wednesday’s Afternoon Commentary, last week’s update (for the week ending Thursday’s July 3) showed China held no 2024-2025 or 2025-2026 US soybeans. However, unknown destinations were showing 1.643 million metric tons and 586,000 mt respectively. The BRACE Industry has been yammering on about how China was going to save the US soybean industry by starting to make bigly purchases during mid-July. Keep in mind this is an annual argument made as the US soybean market sinks seasonally. Also, this group conveniently tends to forget about the US-China trade war and how one side takes Sun Tsu’s approach to the art of war. Anyway. In other news, the National Soybean Index ($CNSI) came in at $9.7025 Wednesday evening putting US available stocks-to-use at 16.5% as compared to the end of June 16.4%.

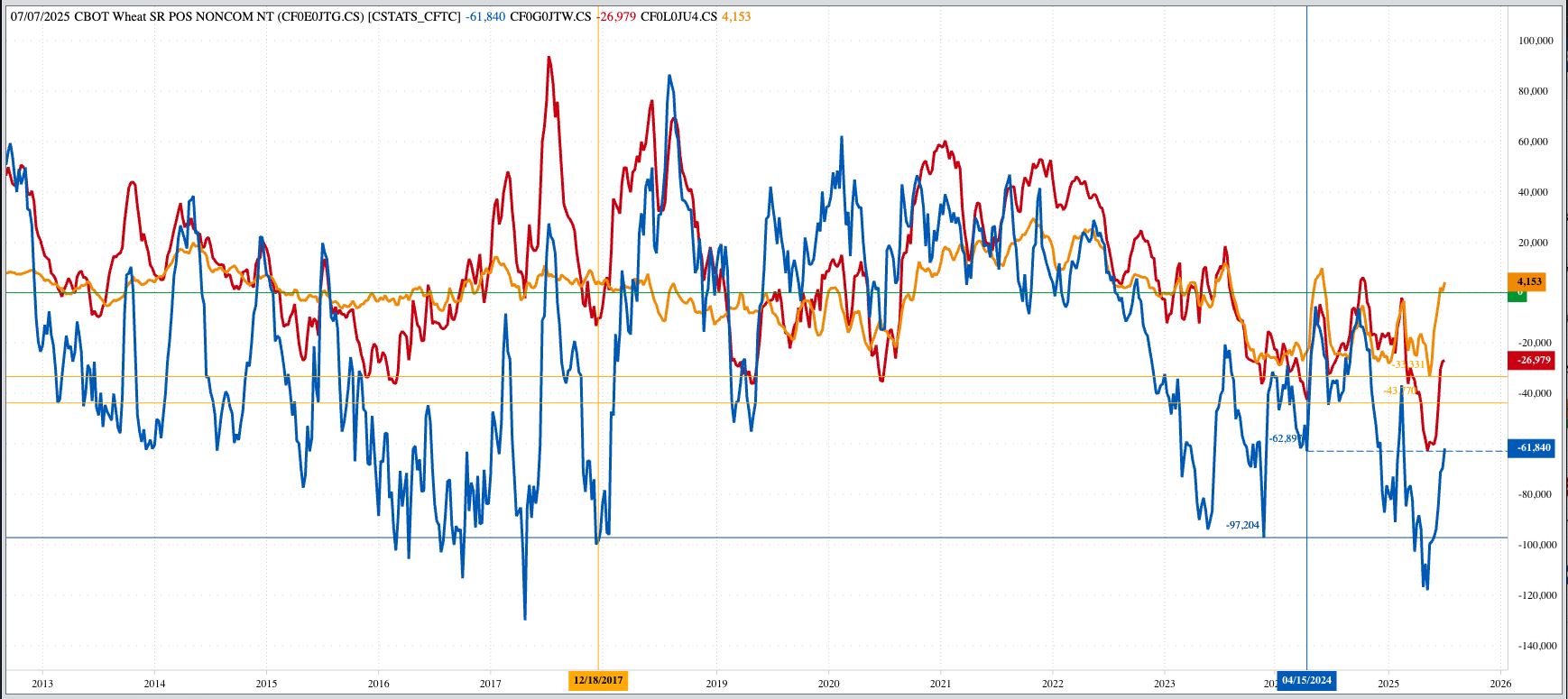

Wheat: The wheat sub-sector was lower pre-dawn Thursday, mostly, with the outlier being the HRS market. However, while September (MWU25) was sitting 2.25 cents higher at this writing, overnight trade volume was light at only 275 contracts. This tells me that if a few sell orders come in before intermission, HRS could follow its winter cousins into the red. That seems logical but given we are talking about wheat I have no idea if it will happen. September SRW (ZWU25) was down 4.0 cents to start the day and sitting on its session low while registering fewer than 4,300 contracts changing hands. Again, I don’t see anything to get excited about as September simply erased Wednesday’s rally overnight. Speaking of yesterday, September closed 3.25 cents higher. Yet when the National SRW Wheat Index was calculated it came in near $4.8575, up 2.75 cents for the day telling us national average basis weakened a bit. This would seem to confirm the idea Wednesday’s rally was largely driven by Watson’s short-covering with merchandisers not wanting to play along completely. Over in HRW we see September (KEU25) down 3.5 cents at this writing, also on its overnight low. HRW remains fundamentally bearish, a factor that hasn’t changed for months.

[i] We will be talking about all this and more at next week’s Barchart Grain Merchandising and Technology Summer Road Show: (LINK)

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.